How To Create A Budget For Financial Freedom

Budget. That word just sounds restrictive. No fun. Depressing.

For the longest time, I was totally clueless about[amazon_textlink asin=’1595555277′ text=’ how to create a REAL budget‘ template=’ProductLink’ store=’poms2moms-20′ marketplace=’US’ link_id=’2f2dbfe3-0944-4523-8e53-4af69cd227bd’]. I would always generally say, “I made this much money, and I have this much left over… I should probably think of the things I want to buy and go do it right away”. Taking a trip to Home Goods or Target was way more fun than saving money or putting it aside for anything else. If I wanted it, I bought it.

*This post may contain affiliate links to products + services we love and use ourselves! We may receive a small commission when you purchase using these links at NO extra cost to you.*

As you probably know by now, I’m a big fan of Dave Ramsey. His practices are so common sense and they help set you up for the future. I don’t know about you, but I’m totally trying to be rich and on the beach by the time I’m 50, and not a day over. If the beach and retirement is in my future, I cannot do it without a budget. Wasting all of my money on the “NOW” things definitely won’t put my ass in the sand any sooner than 65.

How much money do you spend every month on gas? Groceries? Childcare? If you can’t answer those basic questions, you need a budget ASAP.

If you’re ready to put your finances in your own hands and learn exactly where your money is going every month, keep reading.

Step 1- Write down how much money you make

-Write down exactly how much your check is every month or twice a month.

Step 2- Calculate how much money you have going out each month.

-Checking back at last month’s bank statement will really help here. List out every single payment you made and how much you spent.

Step 3- Place the spent money into categories.

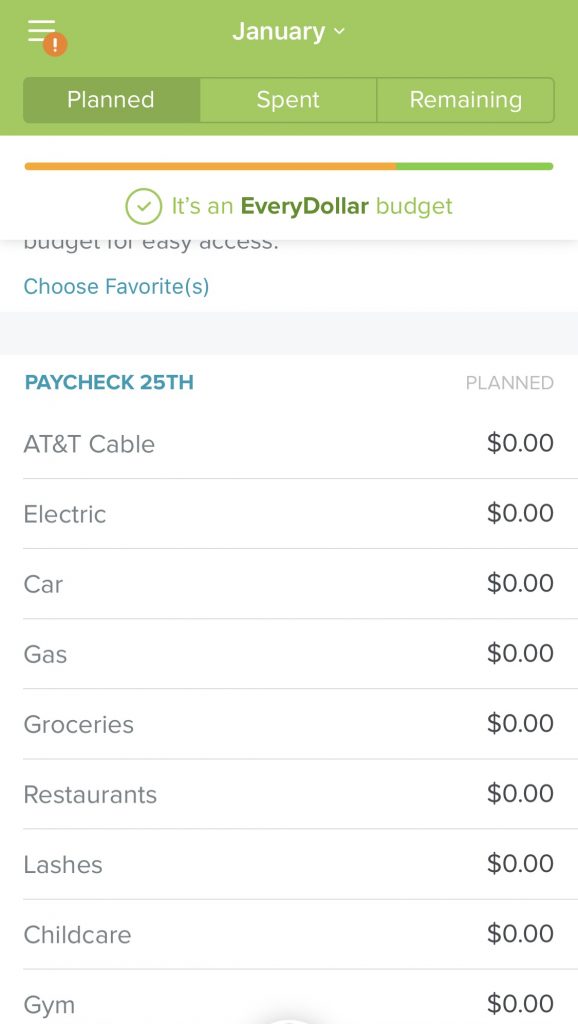

-I have an app called “Every Dollar” downloaded on my phone and it helps me keep track of different things I spend money on every month . Here is an example (this a portion of my budget, so don’t forget important stuff like mortgage, pets, child’s clothes, etc):

And yes, “lashes” IS a line-item in my budget, for real. Don’t judge me.

Step 4- Calculate how much money you plan to spend in each category for the upcoming month.

-I know generally how much money I spend on gas every 2 weeks, so I always budget that number. Childcare can vary for us, so I always budget the higher number just in case. Restaurants is usually super low on the list unless I know we will be out of town and eating out. Otherwise, most of my bills are pretty much the exact same every month. This is a super important step when learning how to create a budget.

Step 5- Determine WHEN you will pay your bills.

-If you get paid twice a month, you might want to consider figuring out which check belongs to which bills. This way, you’ve allotted that money toward particular bills and you know how much wiggle room you have for extras. Oh, and you’ll NEVER be LATE.

-Another Dave Ramsey tip is to always use CASH for things like groceries, gas, restaurants, etc. Word on the street is that your brain actually feels pain when you see CASH leave your hands. Don’t believe me? Next time you’re out spending more than $30, have cash and your debit card and see which one feels more comfortable. Handing over cash or plastic?

Step 6 – Determine what’s most important with the money you have left over.

-This is where I always FAILED when I learned how to create a budget. I saw money sitting in my account and thought it was time to splurge. Here are some things you may put your extra money toward:

- DEBT

- Retirement

- Upcoming vacation

- Christmas

- Emergency money

- Saving for a: home, car, new purse…

If you find yourself with very little money left over after you pay all your bills, you may have to make some sacrifices. Find out which bills you can cut (you can live without cable and subscription boxes once a month). If you’re still having trouble making ends meet, its probably time you find a side hustle.

Step 7- FOLLOW THE PLAN

-There’s really nothing like sitting down, making this huge plan, pretending you’re committed, and then deciding you needed that shirt at Target instead of staying true to what YOU said you wanted. Being smart with your money is a habit and creating new habits aren’t hard unless you make them hard. Stick to your budget for a few months and you’ll feel more in control than ever. Now that you know how to create a budget, you’ve no longer got an excuse to deviate from the plan!

You WON’T be right the first month. Give yourself some grace and head back to the drawing board to refine your budget each month until you’ve got it down to a science. Once you get into it, you will look forward to “budget meetings” because you have learned how to create a budget and YOU are in control.

-Pro Tip- Following the plan is super important, but being flexible is important, too. For example, things come up that you can’t help and you have to change your budget around to accommodate it (and I don’t mean Friendcations, a new iPhone and Kylie’s newest lip kit, I mean car taxes, medical emergencies, etc.). This is another reason leveraging extra money every month is super important so you can cover these things without busting your budget.

So, there you go. Creating a budget will surely lead you to the path of financial freedom if you follow the plan. I love challenging myself to “see how little I can spend” each month so I’ve got LOTS leftover and can put it toward things that I want and things that I will NEED in the future.

What are some things you ALWAYS forget to add into your budget?

About The Author

Shelley

Founder & author of the parenting & lifestyle blog, Poms2Moms. Loves the sunshine, time with friends, practicality, and and the occasional designer shoe. Find me writing about my babies (1 human, 2 furry,) food & fitness, and life in the NFL. Cheers! – Shelley

Denise | 17th Jan 19

I think my big me some comes into groceries I can never keep track of how much money I spend on groceries but these are great tips thanks for sharing